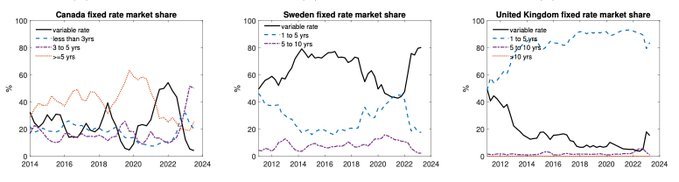

Mortgage markets are not one-size-fits-all. The U.S. is dominated by 30yr fixed-rate mortgages (FRMs). In contrast, Canada, the UK, and Sweden have much higher shares of adjustable-rate (ARMs) or short-term fixed mortgages. Institutional details matter for transmission

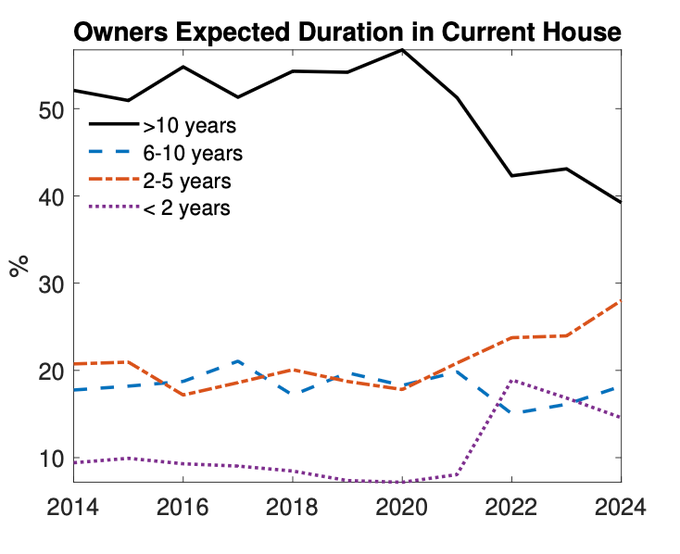

In an FRM country like the U.S., rising rates create a “lock-in” effect. If you have a 3% mortgage, you’re not moving to take on a new one at 7%. We see this in the data! The share of U.S. homeowners expecting to stay >10 yrs fell, while the share expecting to stay 2-5 yrs rose

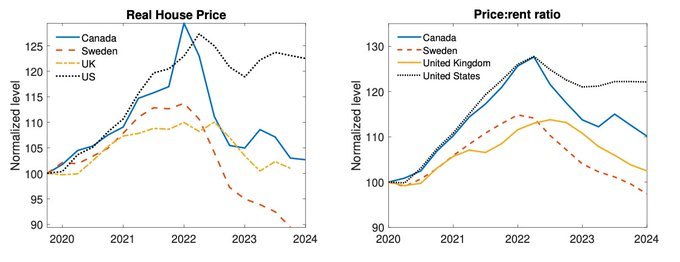

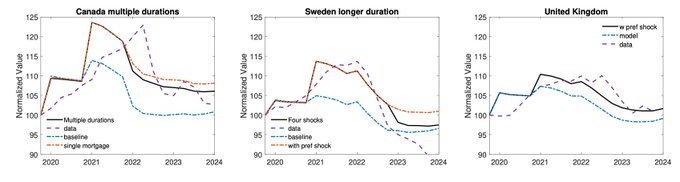

We build a structural model that accounts for these different mortgage structures. When we feed in the pandemic-era shocks, the model replicates the cross-country divergence remarkably well. It captures the U.S. price persistence and the sharper busts in Canada & Sweden.

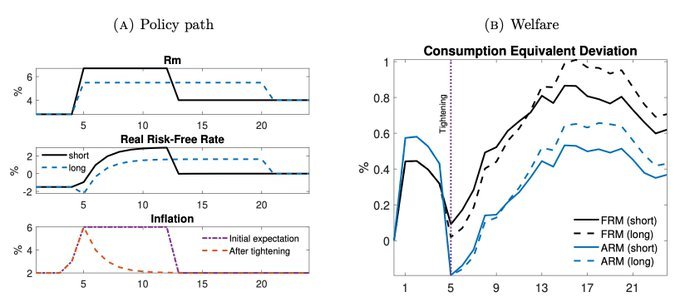

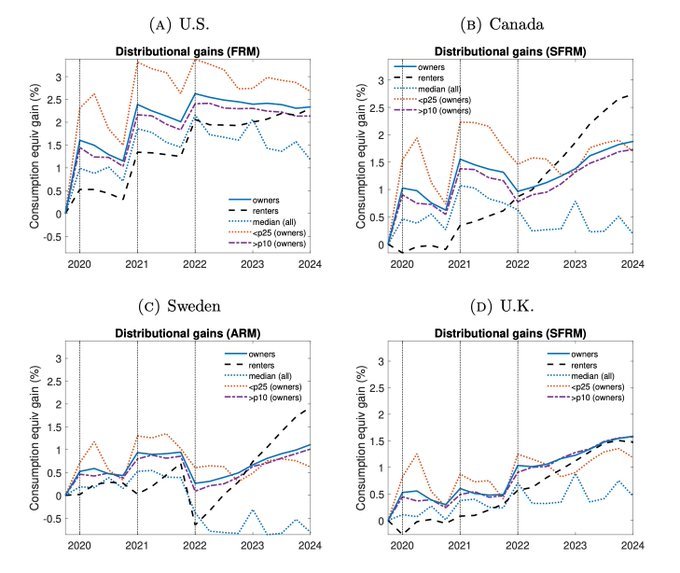

These dynamics have large welfare consequences. FRMs acted as powerful insurance. In the U.S., homeowners’ welfare stayed high even after rates rose. In Sweden, it plummeted. This shows how FRMs shield households during a tightening cycle.

So, does this change how central banks should fight inflation? Our model says yes. A policy experiment shows that in an FRM country like the U.S., a “short & sharp” tightening is better than a long, drawn-out one. The choice of policy path is regime-dependent!