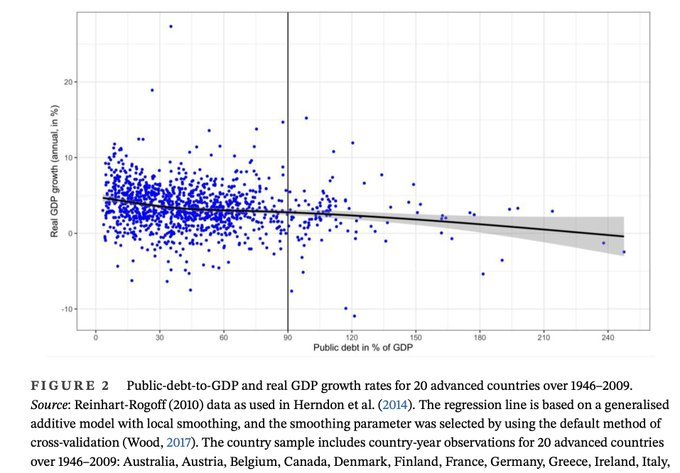

Reinhart/Rogoff (2010) had an impact on the policy debate; policy-makers used their results (threshold in public-debt-to-GDP of 90% beyond which growth slows) to argue for austerity. But what does the evidence tell us about growth effects of higher public debt?

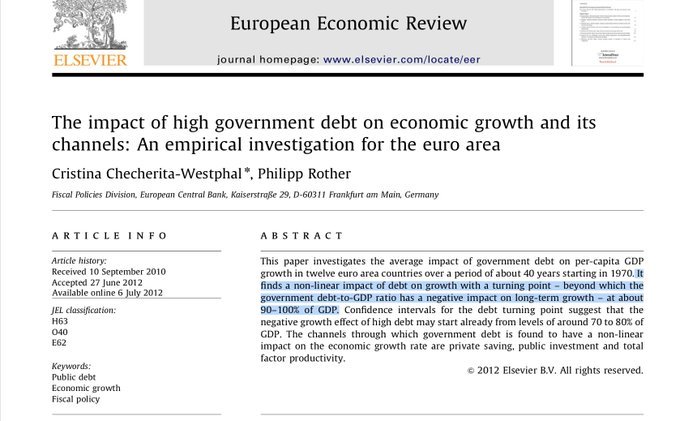

Several papers argue that there is indeed evidence for a negative causal effect of higher public-debt-to-GDP ratios on economic growth, and for a (close to) 90% threshold in the public-debt-to-GDP-ratio beyond which growth falls significantly.

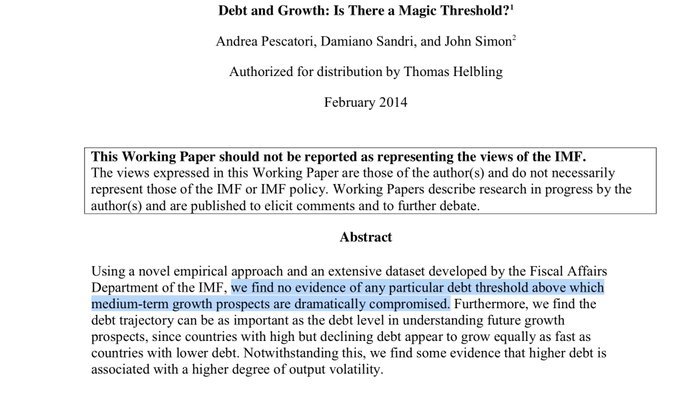

However, other studies argue that the evidence for a causal effect running from higher public-debt-to-GDP to economic growth is weak at best. Furthermore, several authors point to systematic differences in the (non-linear) impact of public debt on growth across countries.

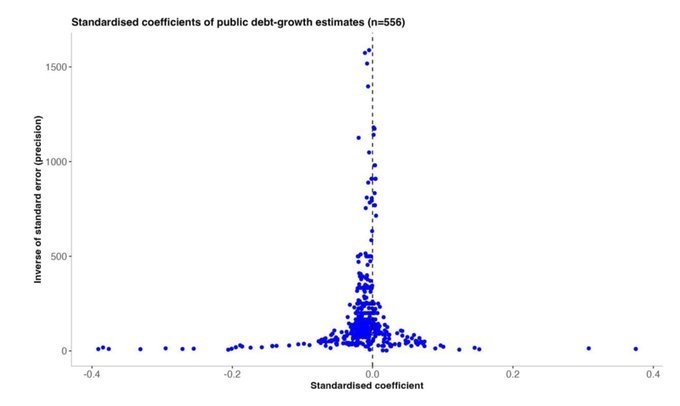

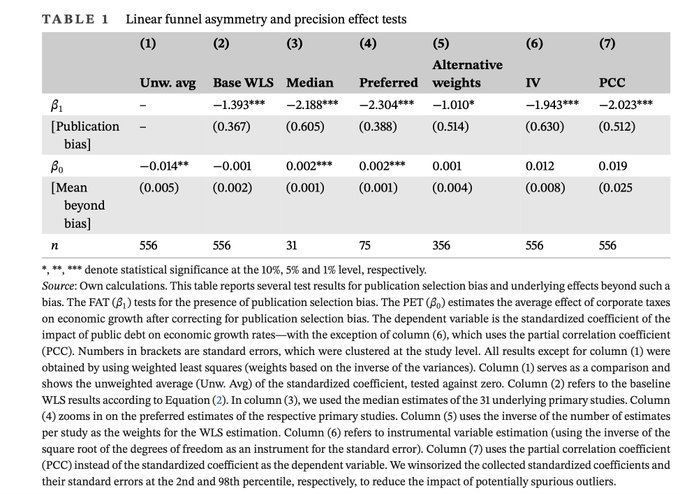

The unweighted mean of the reported results suggests: a 10 %-points increase in public-debt-to-GDP is associated with a decline in annual growth by 0.14%-points – pointing to a penalty for annual growth rates relative to maintaining lower public-debt-to-GDP levels.

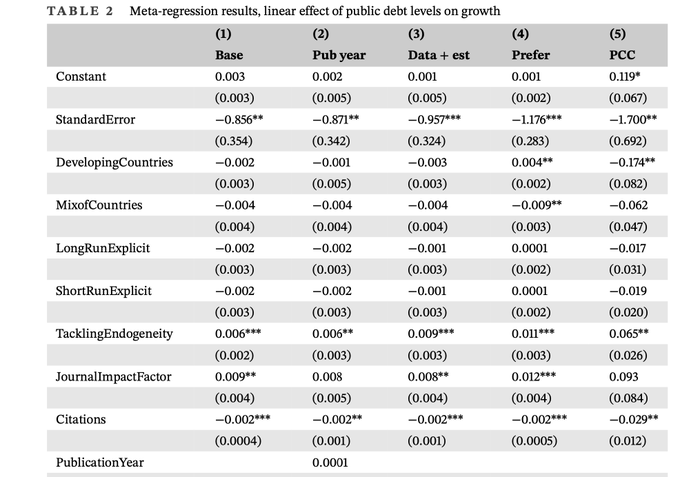

However, estimates are widely distributed, and established tests for publication bias reveal that results indicating a negative linear impact of higher public-debt-to-GDP on growth are over-reported. Once we correct for this bias, we can’t reject a zero average growth effect

Meta-regression analysis further reveals that tackling endogeneity between public debt and growth makes estimates lean less towards the negative side. Endogeneity issues are important, since public-debt-to-GDP and growth can be jointly determined by third factors.

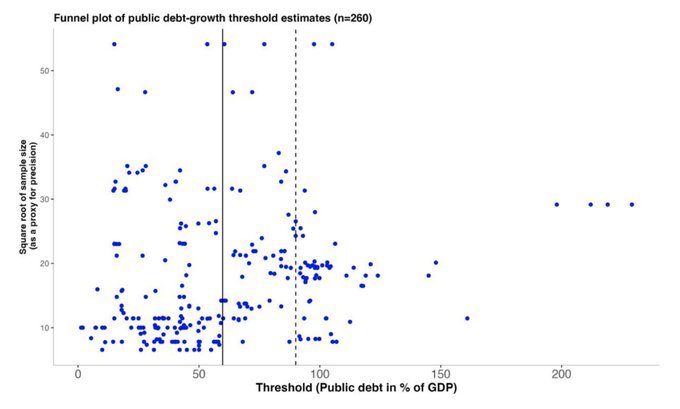

So there is no strong evidence for negative linear effects of higher public debt levels on growth once we correct for publication bias. But what about thresholds beyond which growth slows a la Reinhart/Rogoff (2010)?

the evidence for a universal threshold in public-debt-to-GDP beyond which growth falls is extremely weak. Threshold estimates prominently identified at (close to) 90% are sensitive to peculiar data and specification choices (especially using squared public debt terms).

(“Do higher public debt levels reduce economic growth”?) in the Journal of Economic Surveys: https://onlinelibrary.wiley.com/doi/10.1111/joes.12536