In nearly all industries, Chinese firms invest more, are more productive, but earn less profit.

OECD MAnufacturing Groups and Industrial Corporations (MAGIC) database—that they draw on to do this, and have written several other reports comparing industrial policies and subsidies across countries.

In other recent work they look at semiconductor subsidies across the globe. Firms in China receive far higher subsidies as a percent of revenue ~10%. They also derive much more of their revenue domestically (~50%) and hold far more of their assets domestically (~90%).

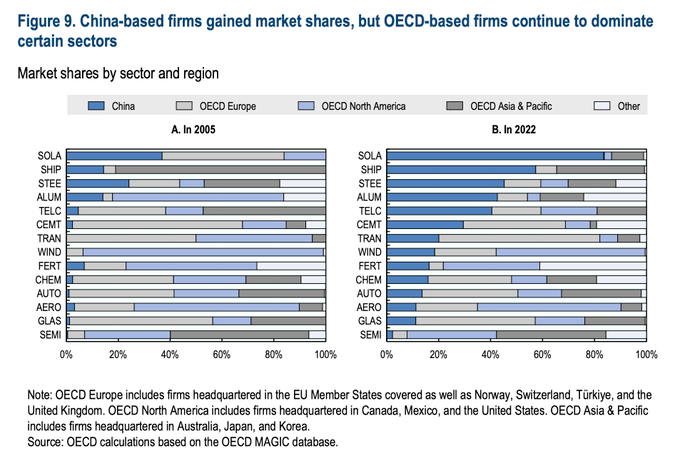

China has systematically gained market share across these 14 sectors.

Below market borrowing is the largest subsidy differentiator in their subsidy database.

Reports The market implications of industrial subsidies (May 2025): https://one.oecd.org/document/TAD/TC(2025)7/FINAL/en/pdf… Recent trends in semiconductor subsidies (April 2025): https://oecd.org/content/dam/oecd/en/publications/reports/2025/04/recent-trends-in-semiconductor-subsidies_dcbb85af/5e91af33-en.pdf… How Governments Back the Largest Manufacturing Firms: Insights from OECD MAGIC: https://oecd.org/content/dam/oecd/en/publications/reports/2025/02/how-governments-back-the-largest-manufacturing-firms_64f9eef0/d93ed7db-en.pdf

More detail on the database: